Bitcoin mining seems crazy!

Computers mining for virtual coins? Is Bitcoin mining just free money?

Well, it's much, much more than that!

If you want the full explanation on Bitcoin mining, keep reading...

Chapters

CHAPTER 1

What is Bitcoin Mining?

Bitcoin mining is the backbone of the Bitcoin network.

Miners provide security and confirm Bitcoin transactions.

Without Bitcoin miners, the network would be attacked and dysfunctional.

Bitcoin mining is done by specialized computers.

The role of miners is to secure the network and to process every Bitcoin transaction.

Miners achieve this by solving a computational problem which allows them to chain together blocks of transactions (hence Bitcoin’s famous “blockchain”).

For this service, miners are rewarded with newly-created Bitcoins and transaction fees.

CHAPTER 2

How Does Bitcoin Mining Work?

What is Bitcoin mining actually doing?

Miners are securing the network and confirming Bitcoin transactions.

Miners are paid rewards for their service every 10 minutes in the form of new bitcoins.

What is Bitcoin Mining Actually Doing?

What is the point of Bitcoin mining? This is something we're asked everyday!

There are many aspects and functions of Bitcoin mining and we'll go over them here. They are:

- Issuance of new bitcoins

- Confirming transactions

- Security

Mining Is Used to Issue new Bitcoins

Traditional currencies--like the dollar or euro--are issued by central banks. The central bank can issue new units of money ay anytime based on what they think will improve the economy.

Bitcoin is different.

With Bitcoin, miners are rewarded new bitcoins every 10 minutes.

The issuance rate is set in the code, so miners cannot cheat the system or create bitcoins out of thin air. They have to use their computing power to generate the new bitcoins.

Miners Confirm Transactions

Miners include transactions sent on the Bitcoin network in their blocks.

A transaction can only be considered secure and complete once it is included in a block.

Why?

Because only a when a transaction has been included in a block is it officially embedded into Bitcoin's blockchain.

More confirmations are better for larger payments. Here is a visual so you have a better idea:

0

Payments with 0 confirmations can still be reversed! Wait for at least one.

1

One confirmation is enough for small Bitcoin payments less than $1,000.

3

Enough for payments $1,000 - $10,000. Most exchanges require 3 confirmations for deposits.

6

Enough for large payments between $10,000 - $1,000,000. Six is standard for most transactions to be considered secure.

Miners Secure the Network

Miners secure the Bitcoin network by making it difficult to attack, alter or stop.

The more miners that mine, the more the secure the network.

The only way to reverse Bitcoin transactions is to have more than 51% of the network hash power. Distributed hash power spread among many different miners keeps Bitcoin secure and safe.

CHAPTER 3

How to Mine Bitcoins

Actually want to try mining bitcoins?

Well, you can do it. However, it's not profitable for most people as mining is a highly specialized industry.

Most Bitcoin mining is done in large warehouses where there is cheap electricity.

To be real:

Most people should NOT mine bitcoins today.

Most Bitcoin mining is specialized and the warehouses look something like this:

That's who you're up against! It’s simply too expensive and you are unlikely to turn a profit.

However:

For hobby mining, we’ll show you some steps you can take to get started mining bitcoins right now.

Step #1: Get Bitcoin Mining Hardware

You won’t be able to mine without an ASIC miner.

ASIC miners are specialized computers that were built for the sole purpose of mining bitcoins.

Don’t even try mining bitcoins on your home desktop or laptop computer! You will earn less than one penny per year and will waste money on electricity.

Step #2: Select a Mining Pool

Once you get your mining hardware, you need to select a mining pool.

Without a mining pool, you would only receive a mining payout if you found a block on your own. This is called solo mining.

We don’t recommend this because your hardware’s hash rate is very unlikely to be anywhere near enough to find a block solo mining.

How do mining pools help?

By joining a mining pool you share your hash rate with the pool. Once the pool finds a block you get a payout based on the percent of hash rate contributed to the pool.

If you contributed 1% of the pools hashrate, you’d get .125 bitcoins out of the current 12.5 bitcoin block reward.

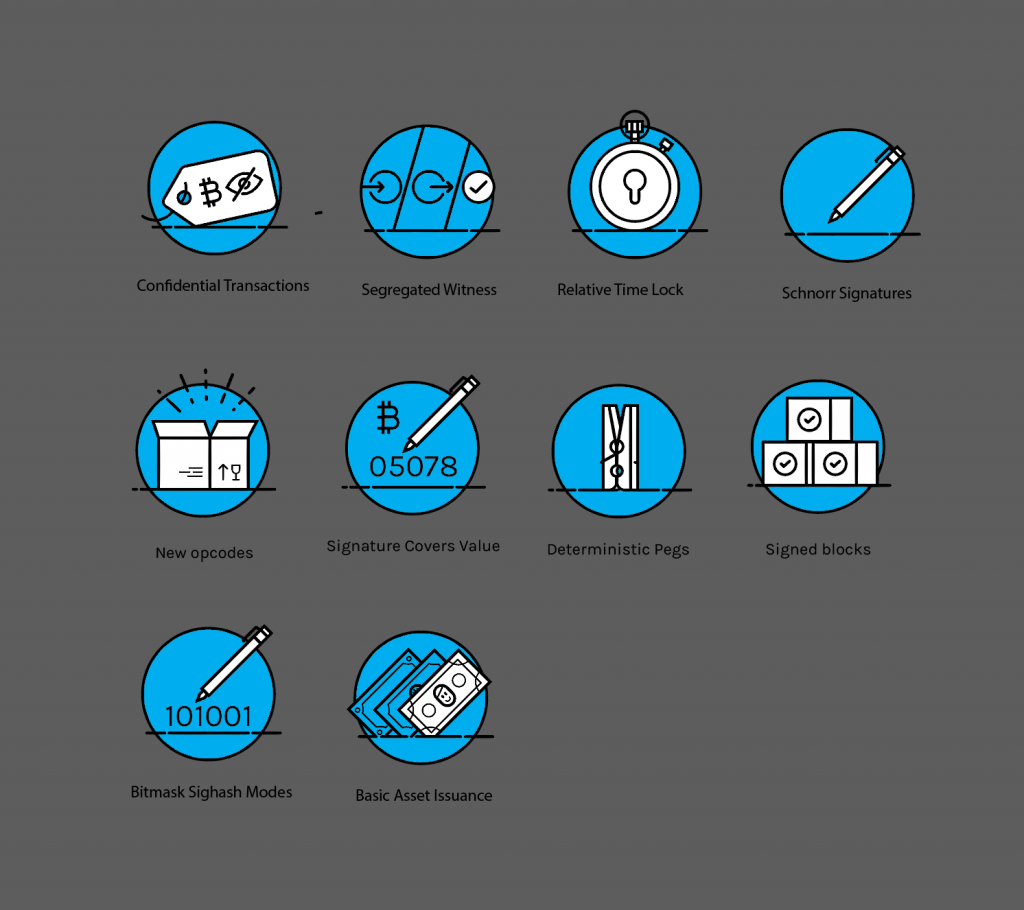

Step #3: Get Bitcoin Mining Software

Bitcoin mining software is how you actually hook your mining hardware into your desired mining pool.

You need to use the software to point your hash rate at the pool.

Also in the software you tell the pool which Bitcoin address payouts should be sent to.

If you don’t have a Bitcoin wallet or address learn how to get one here.

There is mining software available for Mac, Windows, and Linux.

Step #4: Is Bitcoin Mining Legal in your Country? Make Sure!

This won’t be much of an issue in MOST countries.

Consult local counsel for further assistance in determining whether Bitcoin mining is legal and the tax implications of doing the activity.

Like other business, you can usually write off your expenses that made your operation profitable, like electricity and hardware costs.

Step #5: Is Bitcoin Mining Profitable for You?

Do you understand what you need to do to start?

You should run some calculations and see if Bitcoin mining will actually be profitable for you.

You can use a Bitcoin mining calculator to get a rough idea.

I say rough idea because many factors related to your mining profitability are constantly changing.

A doubling in the Bitcoin price could increase your profits by two.

But:

It could also make mining that much more competitive that your profits remain the same.

How to Mine Bitcoins on Android or iOS

Here’s what’s funny:

You actually CAN mine bitcoins on any Android device.

Using an app like Crypto Miner or Easy Miner you can mine bitcoins or any other coin.

What’s not so fun?

You’ll likely make less than one penny PER YEAR!

Why?

Android phones simply are not powerful enough to match the mining hardware used by serious operations.

So, it might be cool to setup a miner on your Android phone to see how it works. But don’t expect to make any money.

Do expect to waste a lot of your phone’s battery!

CHAPTER 4

What is Bitcoin Mining Hardware

Bitcoin mining hardware (ASICs) are high specialized computers used to mine bitcoins.

The ASIC industry has become complex and competitive.

Mining hardware is now only located where there is cheap electricity.

When Satoshi released Bitcoin, he intended it to be mined on computer CPUs.

However:

Enterprising coders soon discovered they could get more hashing power from graphic cards and wrote mining software to allow this.

GPUs were surpassed in turn by ASICs (Application Specific Integrated Circuits).

Nowadays all serious Bitcoin mining is performed on ASICs, usually in thermally-regulated data-centers with access to low-cost electricity.

Economies of scale have thus led to the concentration of mining power into fewer hands than originally intended.

CHAPTER 5

What Are Bitcoin Mining Pools?

Mining pools allow small miners to receive more frequent mining payouts.

By joining with other miners in a group, a pool allows miners to find blocks more frequently.

But, there are some problems with mining pools as we'll discuss.

As with GPU and ASIC mining, Satoshi apparently failed to anticipate the emergence of mining pools.

Pools are groups of cooperating miners who agree to share block rewards in proportion to their contributed mining power.

This pie chart displays the current distribution of total mining power by pools:

While pools are desirable to the average miner as they smooth out rewards and make them more predictable, they unfortunately concentrate power to the mining pool’s owner.

CHAPTER 6

Is Bitcoin Mining a Waste of Electricity?

The media constantly says Bitcoin mining is a waste of electricity.

But, there are some problems with their theories as we'll discuss.

Isn’t Mining a Waste of Electricity?

Certain orthodox economists have criticized mining as wasteful.

It must be kept in mind however that this electricity is expended on useful work:

Enabling a monetary network worth billions (and potentially trillions) of dollars!

Compared to the carbon emissions from just the cars of PayPal’s employees as they commute to work, Bitcoin’s environmental impact is negligible.

As Bitcoin could easily replace PayPal, credit card companies, banks and the bureaucrats who regulate them all, it begs the question:

Isn’t traditional finance a waste?

Not just of electricity, but of money, time and human resources!

Mining Difficulty

If only 21 million Bitcoins will ever be created, why has the issuance of Bitcoin not accelerated with the rising power of mining hardware?

Issuance is regulated by Difficulty, an algorithm which adjusts the difficulty of the Proof of Work problem in accordance with how quickly blocks are solved within a certain timeframe (roughly every 2 weeks or 2016 blocks).

Difficulty rises and falls with deployed hashing power to keep the average time between blocks at around 10 minutes.

Block Reward Halving

Satoshi designed Bitcoin such that the block reward, which miners automatically receive for solving a block, is halved every 210,000 blocks (or roughly 4 years).

As Bitcoin’s price has risen substantially (and is expected to keep rising over time), mining remains a profitable endeavor despite the falling block reward… at least for those miners on the bleeding edge of mining hardware with access to low-cost electricity.

Honest Miner Majority Secures the Network

To successfully attack the Bitcoin network by creating blocks with a falsified transaction record, a dishonest miner would require the majority of mining power so as to maintain the longest chain.

This is known as a 51% attack and it allows an attacker to spend the same coins multiple times and to blockade the transactions of other users at will.

To achieve it, an attacker needs to own mining hardware than all other honest miners.

This imposes a high monetary cost on any such attack.

At this stage of Bitcoin’s development, it’s likely that only major corporations or states would be able to meet this expense… although it’s unclear what net benefit, if any, such actors would gain from degrading or destroying Bitcoin.

Mining Centralization

Pools and specialized hardware has unfortunately led to a centralization trend in Bitcoin mining.

Bitcoin developer Greg Maxwell has stated that, to Bitcoin’s likely detriment, a handful of entities control the vast majority of hashing power.

It is also widely-known that at least 50% of mining hardware is located within China.

However, it’s may be argued that it’s contrary to the long-term economic interests of any miner to attempt such an attack.

The resultant fall in Bitcoin’s credibility would dramatically reduce its exchange rate, undermining the value of the miner’s hardware investment and their held coins.

As the community could then decide to reject the dishonest chain and revert to the last honest block, a 51% attack probably offers a poor risk-reward ratio to miners.

Bitcoin mining is certainly not perfect but possible improvements are always being suggested and considered.

How Does Bitcoin Mining Work?

This simplified illustration is helpful to explanation:

1) Spending

Let’s say the Green user wants to buy some goods from the Red user. Green sends 1 bitcoin to Red.

2) Announcement

Green’s wallet announces a 1 bitcoin payment to Red’s wallet. This information, known as transaction (and sometimes abbreviated as “ tx”) is broadcast to as many Full Nodes as connect with Green’s wallet – typically 8. A full node is a special, transaction-relaying wallet which maintains a current copy of the entire blockchain.

3) Propagation

Full Nodes then check Green’s spend against other pending transactions. If there are no conflicts (e.g. Green didn’t try to cheat by sending the exact same coins to Red and a third user), full nodes broadcast the transaction across the Bitcoin network. At this point, the transaction has not yet entered the Blockchain. Red would be taking a big risk by sending any goods to Green before the transaction is confirmed. So how do transactions get confirmed? This is where Miners enter the picture.

4) Processing by Miners

Miners, like full nodes, maintain a complete copy of the blockchain and monitor the network for newly-announced transactions. Green’s transaction may in fact reach a miner directly, without being relayed through a full node. In either case, a miner then performs work in an attempt to fit all new, valid transactions into the current block.

Miners race each other to complete the work, which is to “package” the current block so that it’s acceptable to the rest of the network. Acceptable blocks include a solution to a Proof of Work computational problem, known as ahash . The more computing power a miner controls, the higher their hashrate and the greater their odds of solving the current block.

But why do miners invest in expensive computing hardware and race each other to solve blocks? Because, as a reward for verifying and recording everyone’s transactions, miners receive a substantial Bitcoin reward for every solved block!

And what is a hash? Well, try entering all the characters in the above paragraph, from “But” to “block!” into this hashing utility. If you pasted correctly – as a string hash with no spaces after the exclamation mark – the SHA-256 algorithm used in Bitcoin should produce:

“6afc21238f2d33e24e168195888721dd5ace05d76196671d6739789af92201ed.”

If the characters are altered even slightly, the result won’t match. So, a hash is a way to verify any amount of data is accurate. To solve a block, miners modify non-transaction data in the current block such that their hash result begins with a certain number (according to the current Difficulty, covered below) of zeroes. If you manually modify the string until you get a 0… result, you’ll soon see why this is considered “Proof of Work!”

5) Blockchain Confirmation

The first miner to solve the block containing Green’s payment to Red announces the newly-solved block to the network. If other full nodes agree the block is valid, the new block is added to the blockchain and the entire process begins afresh. Once recorded in the blockchain, Green’s payment goes from pending to confirmed status.

Red may now consider sending the goods to Green. However, the more new blocks are layered atop the one containing Green’s payment, the harder to reverse that transaction becomes. For significant sums of money, it’s recommended to wait for at least 6 confirmations. Given new blocks are produced on average every ten minutes; the wait shouldn’t take much longer than an hour.

The Longest Valid Chain

You may have heard that Bitcoin transactions are irreversible, so why is it advised to await several confirmations? The answer is somewhat complex and requires a solid understanding of the above mining process:

Let’s imagine two miners, A in China and B in Iceland, who solve the current block at roughly the same time. A’s block (A1) propagates through the internet from Beijing, reaching nodes in the East. B’s block (B1) is first to reach nodes in the West. There are now two competing versions of the blockchain!

Which blockchain prevails? Quite simply, the longest valid chain becomes the official version of events. So, let’s say the next miner to solve a block adds it to B’s chain, creating B2. If B2 propagates across the entire network before A2 is found, then B’s chain is the clear winner. A loses his mining reward and fees, which only exist on the invalidated A -chain.

Going back to the example of Green’s payment to Red, let’s say this transaction was included by A but rejected by B, who demands a higher fee than was included by Green. If B’s chain wins then Green’s transaction won’t appear in the B chain – it will be as if the funds never left Green’s wallet.

Although such blockchain splits are rare, they’re a credible risk. The more confirmations have passed, the safer a transaction is considered.

A Complete Analysis on the Electricity Use of Bitcoin & Why It's not a Waste

In March 2016, Motherboard projected this:

Bitcoin’s electricity consumption will grow to rival that of the nation of Denmark by 2020.

Whatever the accuracy of Motherboard’s math, there’s no disputing the fact that Bitcoin uses a great deal of energy.

On an industrial level, Bitcoin may be considered a system which converts electricity directly into money.

There are two major camps which object to Bitcoin mining due to its electrical cost:

1) The Eco-conscious

The eco-conscious seek to generally diminish global power consumption.

Given that electricity is, at present, primarily generated through unsustainable methods, eco-activists hold that all energy expenditures must be critically weighed against their (debatable) contribution to climate change.

2) Skeptical Economists

Secondly, there are those dubious economists who doubt Bitcoin’s viability.

This group is best exemplified by Paul Krugman, who argues that Bitcoin (and to a lesser extent, gold) has no real value to society and so represents a waste of resources and labour.

Defending Bitcoin’s Power Usage

While disproving the “economic experts” is as simple as referring them to Bitcoin’s current market price and continued existence, explaining why Bitcoin is worth its electrical cost to the eco-conscious requires a more thoughtful approach.

After all, social pressure to sustainably power the Bitcoin project is sensible. We need to maintain a healthy balance between nature and technology.

That said, until advances in green energy diminish or negate Bitcoin’s draw on ecologically-costly energy sources, Bitcoiners must endeavor to defend the expenditure by conveying the importance of this revolutionary peer-to-peer currency!

Here are 9 good reasons which, taken together and in our opinion, completely justify the world’s admittedly high expenditure of electricity on the Bitcoin project:

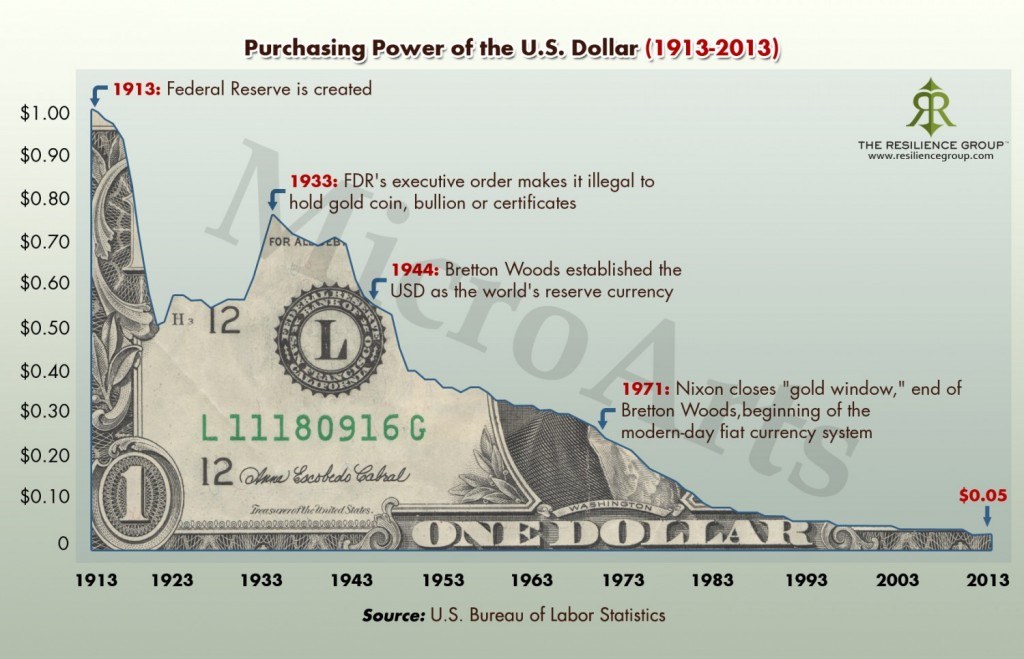

1) Bitcoin is Backed by Electricity (and Ingenuity)

You mean there isn’t an ounce of gold in the bank for every paper Dollar?

Over the millennia, history has repeatedly shown that prosperity depends on sound money. Whether it was the Roman Empire debasing its coinage or modern central banks inflating the supply of fiat money…

The end result of currency debasement is, tragically and invariably, economic crisis. Mr. Mike Maloney’s superb series, “The Hidden Secrets of Money,” thoroughly explores this timeless historical lesson in Episode 5.

Simply put, currency with no backing but faith in its controllers tends to be short-lived and ruinous in its hyper-inflationary death throes.

Bitcoin was designed with one monetary goal foremost in mind: avoiding the dismal fate of previous monetary forms by preventing the evils of debasement.

Rather than trust in some distant, unaccountable human authority’s wisdom and restraint, Bitcoin’s supply limit is enshrined in its code; its “digital DNA,” as a matter of unanimous consensus.

Unlike fiat currency, Bitcoin’s value is also backed by tangible, measurable resources: code running oncomputing hardware powered by electricity.

Given money’s (over-)importance to our modern world, maintaining a technologically-superior alternative to flawed fiat currencies is certainly worthwhile.

2) Mining is a Profitable and Promising Industry in a Slow Global Economy

Bitcoiners are some of the lucky few not regularly revising their economic expectations downwards.

The major determinants of profitability in the fiercely competitive world of Bitcoin mining are low electricity costs, access to cutting-edge ASIC mining hardware and deep knowledge of Bitcoin and business.

Keen businessmen only need apply for this “license to print money.”

Mining tends to be concentrated in China due to several regional advantages; China produces most of the world’s ASIC hardware and has several provinces which over-invested in power generation.

Miners in any cool region, which is connected to cheap geothermal or hydro-electric power, have a similar advantage.

However:

it’s estimated that at least 50% of miners are Chinese. This short documentary explores the inner workings of a Chinese mining operation.

Mining is a growing industry which provides employment, not only for those who run the machines but those who build them. Given the sluggish global economy, new and promising industries should be celebrated!

3) Protection from Inflation and Avoidance of Capital Controls

Of course it’s your money. I just tell you what it’s worth and what you can do with it.

As alluded to in Reason 1, many rulers are diluting the value of “their” national currencies, either as an economic stimulus (mostly to the net-worth of elites) or as a means to cheapen their tremendous debt.

Such debasement punishes savers in particular, as the value of their stored wealth is eroded. Savers naturally seek to protect their fiat savings by translating them to a more durable form, such as foreign currency or investments.

Rulers often block their citizens’ flight to monetary safety by imposing capital controls. China is known for its particularly strict limitations.

Bitcoin mining represents an excellent, legal way to circumvent such restrictions.

Investing in a mining operation brings a steady stream of bitcoins; a form of money largely beyond the control of the ruling class.

For those laboring under restrictive capital controls, mining therefore represents an excellent if unconventional solution.

Given the relative costs and risks of other wealth-preservation measures, it may even be worthwhile to mine Bitcoin at a loss!

Consider one of the popular alternatives, real estate:

Bloomberg estimates that $1 trillion left China in 2015, 7 times more than was offshored in 2014! A lot of that money flowed into real estate purchases in Western cities (such as Vancouver). This phenomenon has created localized bubbles and unaffordable housing conditions for residents. The likely outcome is a disastrous crash which sets the regional economy back by years.

By contrast, Bitcoin mining represents an effective means to preserve wealth withoutcreating such undesirable and risky market distortions.

4) Bitcoin Ultimately Requires Fewer Resources than the Fiat System

“We require more Vespene gas.” -Zerg Overseer

If we take Motherboard’s linear extrapolation that Bitcoin will consume as much power as Denmark by 2020, then add the assumption that Bitcoin will have scaled sufficiently by then to cater to every user of the fiat system… it becomes possible to compare the two systems, in an admittedly rough-and-ready fashion.

Allowing that Bitcoin will replace banks, ATMs, brokers, exchanges and payment services (like VISA, MasterCard and PayPal) around the world, we can offset the electricity required by all those services. Considering the combined electric costs for these operations (covering lighting, air-conditioning, data-centers, website hosting, office equipment and more) the total probably approaches or even exceeds Denmark’s current power usage.

Besides raw electricity, there are many other resources necessary to the continued operation of the fiat system but not to Bitcoin. For example:

- printer paper and other office supplies,

- the armored cars used to transport cash,

- the paper, textiles, ink and power needed to create that cash,

- the gasoline used by all employees driving to and from work every day,

- the resource cost of building offices,

- and so on, ad infinitum.

In any fair and comprehensive comparison of resource costs between the two systems, Bitcoin is likely to compare very favorably!

5) Mining Generates Subsidised Heat

Excess heat from Bitcoin mining – problem or solution?

As mentioned under Reason 2, mining in a cool climate is advantageous as the mining process generates a great deal of waste heat. However, enterprising Bitcoin miners can capture and use this heat productively!

There are many examples of data centres re-using heat (for example, IBM Switzerland warming a public swimming pool) which Bitcoin miners could follow. Waste heat can even be useful to aquaculture and it’s also possible to harness hot exhaust air for drying processes.

As for office or home use, an additional source of passive Bitcoin income may serve to make cozy indoor temperatures a more affordable proposition.

Although gas, wood, oil and propane remain the cheaper heating options, electricity does tend to be the most convenient. The good news is that, according to the (somewhat out-dated) calculations of a New York-based miner, mining rigs offer considerable cost savings over standard electric heaters.

As an additional benefit, mining rigs may be precisely controlled via common computing hardware, such that a customized heating schedule or adaptive climate control system may be programmed with relative ease.

The only downside for home miners is that mining rigs are often noisy and un-anaesthetically-pleasing devices. As a result, they tend to be sequestered in the basement or garage for the sake of domestic harmony. A little ingenuity may be called for to pipe their heat to where it’s more needed in the house.

Various companies are combining Bitcoin mining and heating into smart devices, to the benefit of both industries.

6) Bitcoin Mining can support the IoT ( Internet of Things )

Rise of the Digital Autonomous Corporations and other buzzwords!

Continuing the theme of Bitcoin integration with household and industrial devices, this is the precise business model of potentially-disruptive Bitcoin company, 21.co.

21 raised $120 million in venture capital, a record for a Bitcoin company. As their initial product offering, 21.co released a Raspberry Pi-like device with built-in Bitcoin features; mining included.

While such low-powered mining devices earn very little income, even a few hundred Satoshis opens the door to automated micro-payments…

It’s long been known that Bitcoin offers real potential for machine-to-machine payments. This potential is likely to be realised soon™ with the deployment of the first Lightning Network. The results are bound to be interesting; perhaps even the beginning of a profound technological shift in how we conduct our lives and business!

Smart, interconnected devices offer great promise in terms of self-reporting of problems and supply shortages, even the self-calibration and the self-diagnosis of problems. Bitcoin and additional layers are the most likely payment avenues to cater for these new, developing industries. After all, machines don’t have bank accounts or credit cards. How else will machines pay for their own inputs and how better could they charge for their outputs?

Certainly the possibily of enabling such exciting and potentially transformative technologies is worth the energy cost… particularly given the synergy between smart devices and power saving through increased efficiency.

7) Denmark and Germany Occasionally Struggle with Excess Power

“On Sunday, May 8 [2016] Germany produced so much electric power that prices were actually negative. As in, customers got paid to use the electrical system.” – Fortune.com

It was recently reported that Germany’s solar and wind generation nearly overloaded its electric grid over a particularly sunny and windy day. Power companies paid their customers to use more power so that the energy could be safely dispersed.

Somewhat ironically, considering Motherboard’s comparison, similar excess power situations are known to occur in nearby Denmark.

This means that if you set up in a location which experiences electricity oversupply from variable green sources, it’s possible to get paid for mining Bitcoin as a public service!

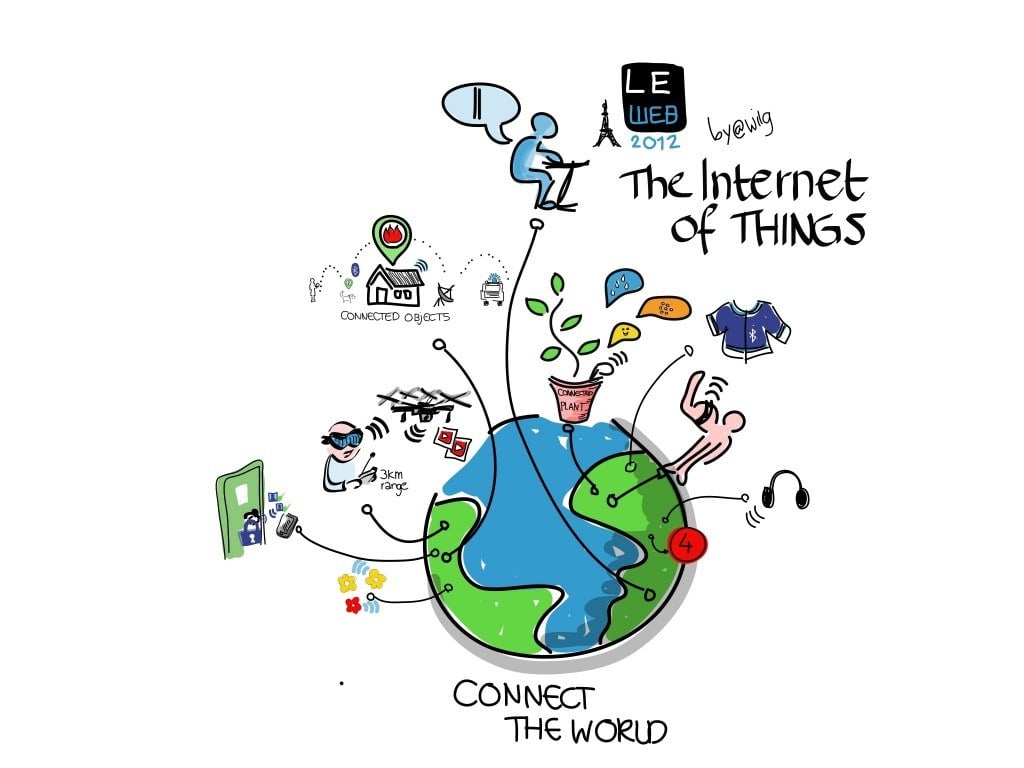

8) Mining Powers Bitcoin’s Tokenized Assets, Secondary Layers and Merge-Mined Coins

Mining Bitcoin isn’t just mining Bitcoin!

If the mining process is the powerful engine driving Bitcoin, then it’s certainly a unique engine in that it loses no efficiency for driving additional processes. Namecoin, the very first altcoin, uses the same SHA-256 Proof of Work algorithm as Bitcoin, which means miners any find solutions to both Bitcoin and Namecoin blocks concurrently. As Namecoin serves a decentralised DNS ( Domain Name Server ), the effect is to bring greater resilience and censorship-resistance to the internet.

Somewhat similar to Namecoin in concept, but more closely tied to Bitcoin, are side-chains. These are essentially separate blockchains which are pegged to Bitcoin’s blockchain. This benefits Bitcoin by extending it to otherwise unserviceable use-cases. It also benefits the side-chain by backing and securing it cryptographically with the huge power of the Bitcoin mining industry.

Tokenized coins are another technology layer with far-reaching implications, which are similarly backed and secured by Bitcoin mining.

By associating particular units of bitcoin with digital, financial or physical assets, ownership of such assets may be exchanged. This works with everything from stocks to in-game items to land deeds and so on. Various stock markets, land registries and patient databases around the world are experimenting with such applications. Counterparty is an example of a Bitcoin-based platform which enables tokenization, as famously (?) seen in the Rare Pepe Directory.

9) Mining Efficiency is Constantly Increasing

Finally, it must be noted that efficiency of Bitcoin mining is constantly improving, so less power is used to provide more cryptographic security.

Since Bitcoin’s release in 2009, mining hardware has evolved from computer CPUs to graphic card GPUs to FPGAs (Field-Programmable Gate Array) and now to ASICs (Application-specific Integrated Circuit). ASIC mining chip architecutre and processes are under continuous development, with lucrative rewards on offer to those who bring the latest and greatest innovations to market.

No comments: